The Impact of Regulatory Uncertainty on the Processing Industry

By Beau Whitney, NIHC Chief Economist

As the hemp industry heads into its third planting season post-2018 Farm Bill, regulatory uncertainty remains as one of the largest risk factors facing the industry. While there has been some clarity in the area of cultivation, the processing sector has been hard hit due to the lack of guidance on which products can be brought to market and if there are legal risks while converting biomass into crude, distillate or isolate. This lack of clarity is creating apprehension on behalf of product manufacturers to contract processors for their services. As a result, the over-capacity in the processing sector is having a devastating effect throughout the value chain.

Uncertainty is resulting in a lack of orders with farmers and processors, even in fiber and grains.

One of the areas that this uncertainty is impacting is the relationship between processors and cultivators. In a survey from the fall of 2020, roughly 65% of cultivators did not have a buyer for their crop. Similarly, with potential regulatory and legal risks associated with the production of products using hemp-based materials, product manufacturers are holding off placing orders with processors of hemp, particularly in the area of CBD. In a separate survey 54% of processors responded that they do not have a buyer for their processed CBD. This uncertainty is also impacting product development and investment in other areas of hemp including fiber and grains. The sentiment being that until regulatory uncertainty is addressed, investors and product manufacturers will continue to take a wait and see approach to hemp.

How is this impacting the processing industry?

The impact of the regulatory uncertainty is rather profound. With the lack of orders, inventories have spiked throughout the supply chain. In addition, having excess inventory, processors have pulled back on how much of their installed capacity will actually be utilized. The current capacity utilization for the processing sector is hovering around 35% to 42%. This has resulted in significant price declines throughout the value chain. The low utilization combined with lower prices has introduced significant stress throughout the industry.

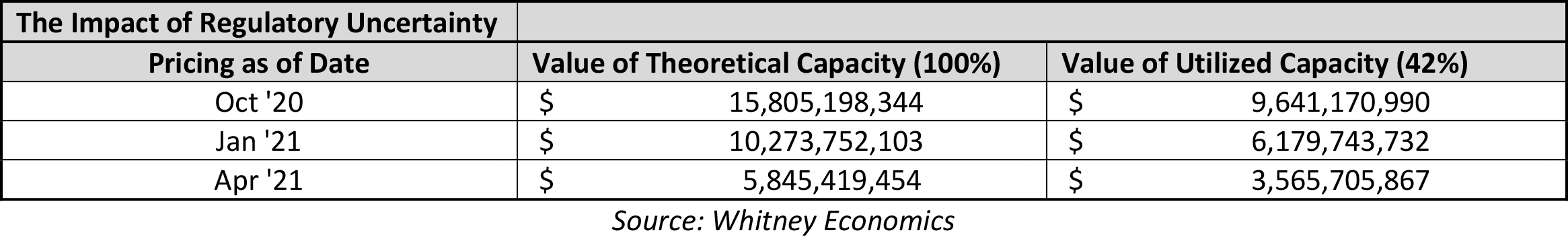

The steep decline in pricing has also had a profound effect on the value of the processing industry. The below chart examines how much value has been lost since October.

The decline in value of the processing capacity has had a rather significant effect on the investment into the hemp infrastructure. Investors are holding off figuring they can get a better price for distressed assets the longer they wait.

Uncertainty as it relates to the definition of hemp as 0.3% THC.

The definition of hemp is playing a part in the current levels of industry uncertainty. With the tight limits on THC content, combined with the variability associated with the current available genetics, investors and operators face difficulty in developing business models that incorporate potential fall-out. Meanwhile, product manufacturers citing potential legal risks are not deploying new hemp products into the retail channels thereby constricting supply in what should ordinarily be an expanding market. This uncertainty-based lack of product deployment is impacting downstream suppliers such as CBD processors and hemp cultivators. Without new products, there is less consumer demand being supported, fewer orders and continued excess supply. This in turn, has led to falling prices and decreased valuations in the processing and cultivation sector.

Given the processing industry’s value has declined by 43% since October, how would a change of definition help address this?

There are simple solutions to this complex issue.

While the function of price versus demand versus uncertainty is a complex one, there are simple yet elegant solutions to the problem. For example, one change being discussed in Congress is in the definition of hemp itself. Many in the industry feel that the 0.3% THC line of demarcation in the definition of hemp is too tight for the hemp industry to operate within. State regulators and agencies tend to agree. A recent vote by the National Association of State Departments of Agriculture (NASDA) showed there was overwhelming bipartisan support for changing the definition of hemp to one percent THC.Proposals have been made in Congress to adjust the definition of hemp to contain notmore thanone percent THC. This proposal makes sense, given that farmers have stated that between 25% and 50% of their crops have tested “Hot,” meaning that their hemp crop is immediately designated at marijuana and a schedule 1 drug and is therefore not commercially viable.

The change to 1% can stop some of the value bleeding.

By increasing the THC limits within the definition, more low-THC (hemp) products can come to market. With more products, comes more confidence in the demand which, in turn, provides more piece of mind for investors and operators when they enter into this space. The question then becomes, is a 0.7% change in THC content worth even a portion of the $9.9 billion decline in capacity value?

Normally, industries are given the freedom to adjust to market forces, however, currently the markets hands are tied based on regulatory uncertainty. With regulatory processes taking years and not months to adjust to the market, it will be up to congress to provide relief to the 31,000 licensees in this space. In the meantime, more operators are facing the grim reality of potentially losing their lands, scaling back production further or exiting the market entirely.