Delta Agriculture™ (Delta Ag) estimates it is the largest full-service provider of hemp in the United States. They aim to provide Fortune 500 companies with sustainable raw goods while focusing on the carbon negative properties of industrial hemp. The company’s clever new tagline, “Powering the Carbon Negative Future,” is more than just words and truly speaks to the vision behind their recently launched rebrand.

This is the core philosophy on which the company is building its brand and business.

Building from the Supply Chain Up

The founders of Delta Ag are supply chain experts. They saw the emergence of industrial hemp as an opportunity to build a supply chain from scratch — one more efficient and environmentally sustainable than any other. “Those opportunities come along very rarely, if ever at all,” says Nick Strawn, Chief Operating Officer, “and we saw that as an exciting challenge, especially given the industry’s significant potential for growth.”

The management team has extensive experience in the oil and gas and manufacturing sectors, specifically in developing and strengthening supply chains. They began investing in cannabis, focusing on developing a proprietary processing technology and associated intellectual property to build upon. They pursued CBD, as it was the immediate opportunity, but have had their eyes fixed on the long-term viability of industrial hemp fiber and grain from the beginning.

“We see hemp as a strong revenue stream because you can truly utilize the whole plant, thereby minimizing waste and costs,” added Graham Owens, President. “It is advantageous for everyone from farmer to product manufacturer to consumer.”

Many, both inside and outside the industry, treat hemp as a boutique crop. But from the beginning, Delta Ag sought to change that perception by scaling their operations with a big-ag commodity approach never before attempted within the industry. That is one of the many reasons the company chose to join the National Industrial Hemp Council (NIHC): The shared vision of jointly enacting the change needed to responsibly grow and sustain the U.S. hemp industry.

“We recently joined NIHC because we share similar philosophical values, and felt that together, as partners, we have the ability to influence change at the highest regulatory levels,” says Owens. “We see the impact NIHC has already made, and we want to be a part of that process.”

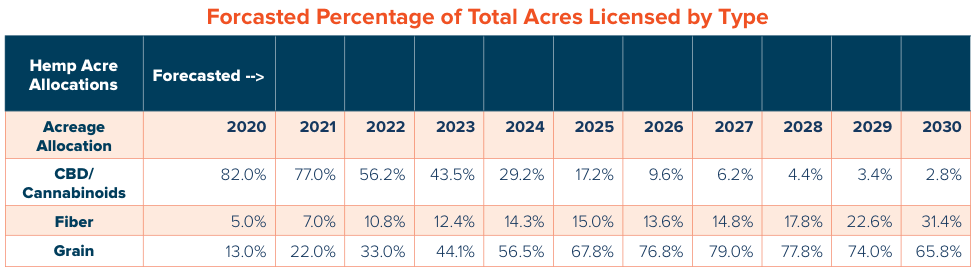

“We see opportunity in large industrial applications, but at the moment, the industry is fractured,” says Strawn. “We have managed to bring together a vibrant supply chain in a relatively short amount of time, up and down the marketplace, similar to what we did for oil and gas. While we initially focused on monetizing the flower, our sights are set on utilizing the whole plant and expanding our fiber and grain production.”

______

Delta Ag sought to change that perception by scaling their operations with a big-ag commodity approach never before attempted within the industry. That is one of the many reasons the company chose to join the NIHC: The shared vision of jointly enacting the change needed to responsibly grow and sustain the U.S. hemp industry.

______

Empowering Business Model

At the outset of 2020, Delta Ag was fully funded and ready to do business right as the pandemic hit. For a group of leaders who had weathered plenty of challenges before, COVID didn’t stop the Delta Ag team from building a network of farmers stretching from Delta, CO, to Slaton, TX, to Eddyville, KY that feeds their production.

“A lot of farmers jumped into hemp farming with big dreams,” says Owens. “Farmers were left out to dry. We recognized the value in actually partnering with farmers, trusting these experts to do what they do, and paying them what they deserve to farm the plant. They are the backbone of the entire company.”

“When farmers are contracted, Delta Ag builds a nearby processing facility and manages the harvest for the farmer with a proprietary model that takes pressure off the farmer. Our farmers use their expert ‘standard operating procedures’ to grow the plant, and we have learned a lot from them,” says Owens.

Hemp Feeds Economies

The goal of Delta Ag is to lead the industry in producing high-quality hemp fiber, grain, and flower at scale. In fact, to their knowledge, they are the only ones currently doing at to this level.

The goal of Delta Ag is to lead the industry in producing high-quality hemp fiber, grain, and flower at scale. In fact, to their knowledge, they are the only ones currently doing at to this level.

“Each facility can dry and process approximately 60,000 to 100,000 pounds of product per day and 100,000 pellets per day of biomass,” says Strawn. “We sell our flower to extractors for the oil. They then sell the oil isolate to manufacturers.” Delta Ag recently announced the launch of its hemp fiber line, marking a transitional growth from leader in hemp flower production into a full-scale industrial hemp supplier.

But it’s not just production. The company is also focused on working with policymakers to develop the regulatory framework needed for the industry to thrive, starting with regulations around using hempseed for animal feed.

“We see the future of the industry on the grain and fiber side. In the case of animal feed, it is tricky,” says Owens. “You can get a smoothie that contains hemp-based protein. Yet, right now, due to restrictions on selling commercial hemp for animal feed, we can eat hemp, but we can’t feed our livestock and animals hemp. U.S. regulators say they need to see more data from studies from U.S. producers, despite much of the world having studied and used hemp for animal feed for decades.”

In December 2018, the FDA found that hemp seed-derived ingredients for use in human food — including hemp seed oil, hemp hearts, and hemp protein powder — were considered “Generally Recognized as Safe” (GRAS) for human consumption after careful evaluation. In fact, not only did the FDA approve these products as safe for human consumption, but hemp seeds are considered a superfood with immense nutritional value.

Yet, restrictions on hemp-based animal feed persist. The FDA has been slow to address it, and lawmakers continue to be confused about hemp and hemp-derived products. Despite the FDA recognizing hemp-derived foods as generally safe and studies having been conducted globally for years, the agency continues to claim the impact on the food supply chain has not been fully studied.

“There is a clear misunderstanding on how hemp-based animal feed would impact the human food supply chain,” says Owens. “The animal eats the feed, and then that animal becomes available for human consumption. The chicken-and-egg scenario is that the FDA wants market studies, but, without funding for such studies, it is difficult for the industry to conduct studies if the feed cannot be used in the first place. This is particularly frustrating considering the ban even extends to hemp being used as an ingredient in feed for animals not intended for human consumption.”

“Generally speaking,” says Owens, “our biggest regulatory obstacle is a lack of guidance from the FDA — an agency that has understandably prioritized addressing COVID over the past year and a half. The industry needs regulatory clarity, and we want to work with the NIHC and others towards achieving this goal.”

With recent freezes and protein shortages, this approach leaves our country’s food and beverage manufacturers very vulnerable. Delta Ag sees an opportunity for U.S. farmers to be world leaders in this segment and fill that void. “There is a worldwide feed shortage. American food prices are skyrocketing, and there is global fallout from this shortage,” says Owens. “We see a clear path forward to make U.S. hemp farmers the leading supplier of hemp feed. We could potentially lead the world out of this shortage, providing real jobs and economic stability and stimulation for rural American communities along the way.

______

“U.S. policymakers must position our farmers as the world’s foremost leaders in the production of industrial hemp – our nation’s food suppliers, environment, and families pocketbooks depend on it.”

– Graham Owens

______

Hemp’s Environment Benefit

Delta Ag’s tagline “Powering the Carbon Negative Future,” celebrates that hemp absorbs 100,000 tons of carbon dioxide directly from the environment with every 10,000 acres planted. Currently operating more than 5,000 acres of farmland in West Texas, Kentucky, and Colorado, Delta Ag is on target to plant 10,000 acres this year and scale to more than 25,000 acres in 2022 — reducing the carbon dioxide in the air by millions of tons in the process.

“Hemp has environmental benefits that are second to none,” says Owens. “Hemp is the ideal carbon sink. Not requiring a lot of water, which hinders other crops, hemp is uniquely capable of surviving droughts. It revitalizes soil, so it makes a great alternative crop and contains high levels of protein and nutrients. With a plant to harvest cycle of 4 months, it can keep farmers busy year-round, and the whole plant can be utilized, like no other crop.”

“Our team has years of experience of crafting supply chains to meet end-product manufacturers demands, and we are building a network of hemp producers to work with us on the effort,” says Owens. “While we see animal feed as a place where we can immediately make an impact with hemp [given the feed shortage], there are so many other applications such as bioplastics, paper and paper products, oils for body care products and food, and even industrial building materials. With the right regulatory framework, it is a billion-dollar crop.”

According to Delta Ag’s CEO George Overbey, “Hemp is a miracle crop. Delta Ag is harnessing the power of the hemp plant to make a carbon-negative future possible right here at home and one day, globally.”

Learn more at https://deltaag.com/

NHIC is pleased to share that Delta Ag CEO George Overbey is a speaker at the NIHC 2021 Hemp Business Summit, speaking on, “A Path to Change the World, Starting with America’s Farmers.”

NHIC is pleased to share that Delta Ag CEO George Overbey is a speaker at the NIHC 2021 Hemp Business Summit, speaking on, “A Path to Change the World, Starting with America’s Farmers.”

In what is sure to be a highlight next month in Washington, Jay Noller, the Executive Director of the Global Hemp Innovation Center, will be providing the keynote address at

In what is sure to be a highlight next month in Washington, Jay Noller, the Executive Director of the Global Hemp Innovation Center, will be providing the keynote address at

Todd Van Hoose is President and CEO of the Farm Credit Council, where he leads the national trade association’s efforts to represent the Farm Credit System’s interests before Congress, the Administration, and various federal regulatory agencies. He also serves on a variety of leadership bodies within Farm Credit, including the Presidents’ Planning Committee and the Business Practices Committee.

Todd Van Hoose is President and CEO of the Farm Credit Council, where he leads the national trade association’s efforts to represent the Farm Credit System’s interests before Congress, the Administration, and various federal regulatory agencies. He also serves on a variety of leadership bodies within Farm Credit, including the Presidents’ Planning Committee and the Business Practices Committee. Melissa Marsal is Chief Operating Officer of West Town Bank & Trust and has been with the Bank for over a decade. She oversees all aspects of Operations and is also responsible for helping the Bank build a program uniquely tailored to the challenges of hemp-related businesses. Through the Bank’s partnership with RiskScout, Inc., they provide a client experience that reduces the time to open a bank account from weeks to a matter of hours.

Melissa Marsal is Chief Operating Officer of West Town Bank & Trust and has been with the Bank for over a decade. She oversees all aspects of Operations and is also responsible for helping the Bank build a program uniquely tailored to the challenges of hemp-related businesses. Through the Bank’s partnership with RiskScout, Inc., they provide a client experience that reduces the time to open a bank account from weeks to a matter of hours. Sundie Seefried is CEO of Safe Harbor Financial, located in Denver Colorado. She is the former CEO of Partner Colorado Credit Union and retired from her credit union career of 38 years to focus her full attention on cannabis banking. In 2014 instead of retirement, she designed a full scope Cannabis Banking Program known as the Safe Harbor program which has withstood the scrutiny of 15 Federal and State exams to date.

Sundie Seefried is CEO of Safe Harbor Financial, located in Denver Colorado. She is the former CEO of Partner Colorado Credit Union and retired from her credit union career of 38 years to focus her full attention on cannabis banking. In 2014 instead of retirement, she designed a full scope Cannabis Banking Program known as the Safe Harbor program which has withstood the scrutiny of 15 Federal and State exams to date.

The goal of Delta Ag is to lead the industry in producing high-quality hemp fiber, grain, and flower at scale. In fact, to their knowledge, they are the only ones currently doing at to this level.

The goal of Delta Ag is to lead the industry in producing high-quality hemp fiber, grain, and flower at scale. In fact, to their knowledge, they are the only ones currently doing at to this level. NHIC is pleased to share that Delta Ag CEO George Overbey is a speaker at the

NHIC is pleased to share that Delta Ag CEO George Overbey is a speaker at the

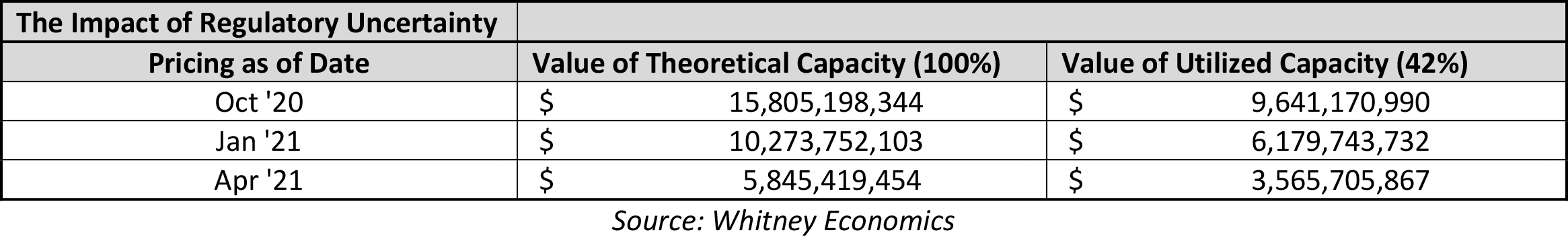

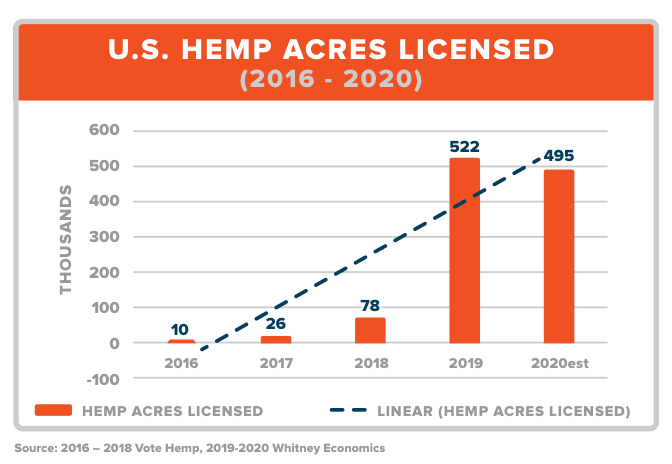

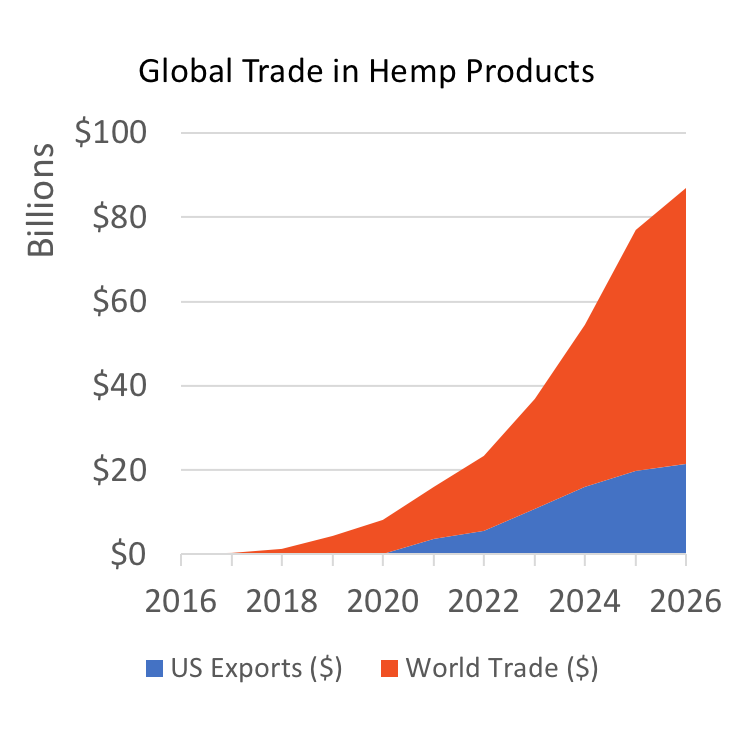

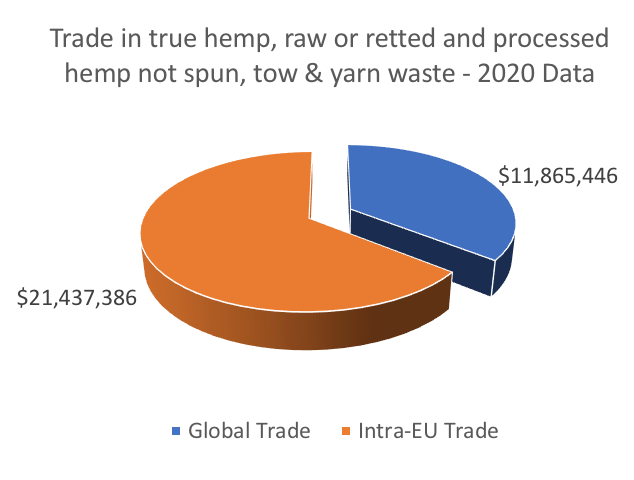

Export values were $0.79 million, down, however, from $8.9 million in 2017, to $2.8 million in 2018. Global trade of industrial hemp for fiber use has increased about 380% annually over the same time-period, but with significant volatility.(1) Global trade in industrial hemp and hemp-based products was over $8.1 billion in 2020 and is forecast to be more than $65 billion by 2026. NIHC estimated that U.S. exports of hemp seed, meal, oil and hemp-based processed products (including cannabidiol-based) exceeded $1.8 billion in 2020. U.S. exports of industrial hemp products are forecast over $21 billion by 2026.

Export values were $0.79 million, down, however, from $8.9 million in 2017, to $2.8 million in 2018. Global trade of industrial hemp for fiber use has increased about 380% annually over the same time-period, but with significant volatility.(1) Global trade in industrial hemp and hemp-based products was over $8.1 billion in 2020 and is forecast to be more than $65 billion by 2026. NIHC estimated that U.S. exports of hemp seed, meal, oil and hemp-based processed products (including cannabidiol-based) exceeded $1.8 billion in 2020. U.S. exports of industrial hemp products are forecast over $21 billion by 2026.

Based on industry input, NIHC has developed both short-term and long-term responses in partnership with USDA’s Foreign Agricultural Service. In addition to engaging European and Asian trade experts, NIHC is building a communication strategy that will provide international visibility for the U.S. hemp industry. In the short-term this means ensuring that U.S. products, product availability and production standards are developed and shared.For the long-term, NIHC’s strategic vision includes expanding these efforts by partnering with USDA to understand the supply chain in target markets, identify market access constraints, develop technical solutions food, feed and supplement use along the value chain, and life cycle assessments to ensure that hemp generally, and US hemp in particular, is valued for its sustainability credentials.

Based on industry input, NIHC has developed both short-term and long-term responses in partnership with USDA’s Foreign Agricultural Service. In addition to engaging European and Asian trade experts, NIHC is building a communication strategy that will provide international visibility for the U.S. hemp industry. In the short-term this means ensuring that U.S. products, product availability and production standards are developed and shared.For the long-term, NIHC’s strategic vision includes expanding these efforts by partnering with USDA to understand the supply chain in target markets, identify market access constraints, develop technical solutions food, feed and supplement use along the value chain, and life cycle assessments to ensure that hemp generally, and US hemp in particular, is valued for its sustainability credentials. Fazio (pictured) found his way into industrial hemp through a career in law enforcement. Like many others in the industry, he saw opportunity and had the ingenuity to pursue it.

Fazio (pictured) found his way into industrial hemp through a career in law enforcement. Like many others in the industry, he saw opportunity and had the ingenuity to pursue it.