Day two of the NIHC’s 2022 Business, Research, and Farm Summit brought an intriguing conversation about the challenges of hemp banking and the risk management practices financial institutions must consider before engaging in this emerging industry.

We also heard from some of our industry colleagues from other hemp trade associations about how working together works and about how hemp growers can become certified as organic.

We thought we were done after an intriguing conversation with NIHC members Delta Agriculture and element6 Dynamics about how they’re both working to bring conventional farming practices to the hemp industry….

But we ended the Summit with a big announcement about NIHC and added a well known name to our ranks.

Read on for the complete day two wrap. Whether you joined us in person or virtually, thank you for participating in the 2022 Business, Farm, and Research Summit.

Hemp Banking is Here Today (Panel 5)

We have come a long way in 2022 with farm credit and banks engaging and offering services to the hemp industry.

Attendees at the 2022 Business, Farm, and Research Summit heard directly from one of our industry’s leading banks and an American Bankers Association (ABA) official.

Ed Elfmann representing the ABA as the SVP of Agriculture and Rural Policy, addressed the irony that the American Bankers Association has had an agriculture committee since 1913 – and in the hemp life cycle, they were probably lending to hemp farmers back then, and then it’s come full circle. It seems we’re starting over again.

“From a lending standpoint and a USDA perspective, it’s important to understand the industry,” Elfmann said.

He addressed further challenges of financing the hemp industry. For instance, Elfmann used the example of what if you have been funded and your crop tests hot three times in a row. Or what happens if Dad has a license and the son helps farm, but the dad passes away?

These are all challenges the banking industry is trying to solve so that capital flows freely to help operators.

“We’re trying to be partners in this at the end of the day,” Elfmann said. “We’re not trying to be adversarial; we want to work with you.”

As a banker, Elfmann asked Ross Sloan, SVP of Hemp and Cannabis Banking at West Town Bank and Trust do you treat hemp differently than other commodities.

“Yes, there are unique challenges with hemp in each sector,” Sloan said.

From the grower’s perspective, there is testing. For processors, Sloan said that the in-process limits need to comply with the law, which is challenging.

As it relates to the SAFE Banking Act, Elfmann says from a banking perspective that it presents a challenge when companies are growing and processing higher-THC marijuana.

Some challenges include whether the equipment financed and used for marijuana and hemp cultivation or even selling higher-THC and hemp-derived products presents a challenge with funds segregation.

Elfmann used the example that if you own a strip mall with a dispensary and that dispensary pays rent, then that strip mall owner is now violating federal law.

“These are nuances,” said Elfmann. But those are the risk management issues that banks consider every day. “Have proper documentation. Like any business, this industry needs to be the same [as other businesses] for your banker to feel comfortable.”

He advised attendees to have their business plan, cash flow statements, etc., and share them with their bankers.

For hemp growers and processors who are just starting an agribusiness, Elfmann encourages them to enroll in programs like the USDA’s Beginning Farmers program at USDA or SBA loans. Elfmann notes that these loans guaranteed by the federal government help banks reduce the risk.

“USDA programs, if you’re able to use them, are tremendous,” said Elfmann.

Working Together Works! Who is Who in the National Hemp Trade Associations? (Panel 6)

Individuals, organizations, and companies often ask, “With so many trade associations in the hemp industry, which one should I join?” With a small group of organizations engaged in the national hemp industry, no rule says you can only belong to one!

Today, we heard about how our industry groups are working together on behalf of the hem industry. NIHC President and CEO Patrick Atagi moderated a panel of leading hemp associations that included Mandi Kerr, CEO, and Founder of the Global Hemp Association; Jacob Waddell, Executive Director of the U.S. Hemp Building Association; and Fred Cawthorn, Vice President of the U.S. Hemp Roundtable.

Wadell said at the beginning, “There is power in numbers. We need to start working together and soothing any issues that we have,” noting how hemp industry associations can work together.

Noting other industry trade associations have been working together, Wadell said we need to copy that blueprint to continue making the strong argument for the hemp industry to continue to deliver wins for hemp operators.

Atagi started the discussion with a question about what you would do without any budgetary constraints.

Kerr talked about entering into existing markets.

“We need to be the go-to for sequestering carbon,” Kerr said, noting that she wants to put together a hemp road show to highlight throughout different parts of the country what the hemp plant can do while also putting together a database for the industry to further inter-industry collaboration.

Cawthorn noted the synergies within the hemp industry.

“Three years ago, we weren’t here,” referring to sitting at a table together at an industry conference. Cawthorn highlighted projects he’s working on within Tennessee with Wadell and the U.S. Hemp Building Association.

But where are we headed Atagi asked.

Atagi talked about the need to be bipartisan, find ways to work together, and “put our best foot forward.” He spoke about how as an industry, NIHC is leading an effort through FAS’s Market Access Program with the folks at Let’s Talk Hemp to create an expo in Asia to open up the Asian market for U.S. hemp products.

Organics: A Market for Hemp Products

The organic industry tops over $50 billion in sales annually, making it the fastest-growing American food and agriculture segment. The USDA organic label is the gold standard for product differentiation in the marketplace. Hemp producers and processors can also benefit from this voluntary labeling program by obtaining premiums for their products and meeting their consumers’ demands.

Oregon Tilth works to make our food and agriculture biologically sound and socially equitable. They see the marketplace as the best opportunity to drive change in how we produce food and other products – including hemp.

Levi Frederickson, who helps lead the mission at Oregon Tilth as an Education Services Specialist, spoke today at the Summit and talked about hemp fits into the equation.

He noted that Oregon Tilth has been helping hemp farmers and processors become certified organic and maintain that certification since 2019. Currently, Frederickson said that Oregon Tilth certifies 150 businesses growing or handling organic hemp or organic hemp derivatives.

“We’re here for free,” Frederickson said, noting that they can help you assess before you plant or develop a label, a process, or a formula.

Frederickson addressed some of the common questions he gets about hemp.

With regards to feminized seeks, he said yes, they can be considered organic, to a certain extent. Addressing ethanol use in extraction, Frederickson says that corn-derived ethanol should be certified organic for hemp production.

THC levels of hemp do not affect its organic certification. Still, Frederickson notes that if the hemp test above .3 percent delta-9 THC then it’s not considered hemp but could still be considered organic.

Lastly, while he said Oregon Tilth could not recommend a specific compliant spray for hemp russet mites, he did say that he could provide a list of sprays that could be used and still meet an organic certification.

He says Oregon Tilth certifies is not specific to Oregon but can certify in all 50 states. You can call them at (541) 201-8042.

Bringing Conventional Farming Practices to the Hemp Industry (Panel 7)

Delta Ag and element6 Dynamics (formerly Sana Fe Farms) are the largest producers of hemp in the country, and Fortune 500 countries trust their carbon-negative materials.

Attendees heard from Issac Cohen, the VP of Cultivation at element 6; Graham Owens, President of Delta Agriculture and Jona Williams, the SVP of Operations at Delta Agriculture.

While hemp might be a new crop, both companies are implementing traditional agriculture practices in this emerging and exciting industry.

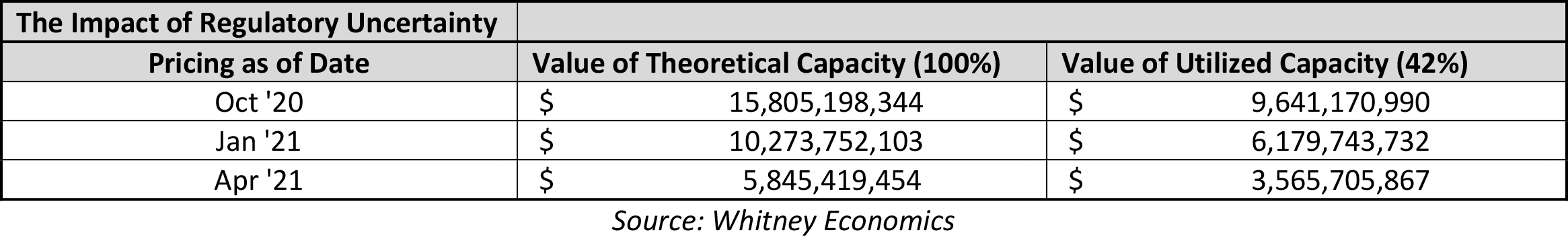

Williams started by referencing NIHC Chief Economist Beau Whitney’s presentation that roughly 60 percent of hemp growers fear they won’t be in business in two years. Williams noted that we need to grow and process the whole plant.

“If you were raising cattle only for the filet, then you wouldn’t be in business very long,” said Williams.

His colleague at Delta Ag, Owens, agreed, saying that companies like theirs and element6 are successful because they have lined up buyers and can show farmers there is a pathway to profitability in the hemp marketplace. Otherwise, “none of it matters,” Owens said, referencing the other conversations that have been occurring at the 2022 Summit around the end use of products, standards, and carbon offsets because we must grow hemp first.

“We’re not unique. We’re like every other row crop,” Owens said.

Cohen from element6 Dynamics says that in conversations with farmers across the country, they like the challenge of growing a new crop like hemp. Their approach is to work with other growers and plant hemp next to other row crops to show the value of hemp as a rotational crop.

“We believe we need to plant more than 20 acres to prove the value of it,” referencing educating farmers about planting a new crop like hemp.

Williams chimed in by saying, “margins matter” while referencing the price of gas and the cost of transportation. The closer the yield can be to the processing facilities, the better.

Williams also addressed the surprise of farmers not realizing that hemp can be grown and harvested just like any other row crop with farming equipment like combines. He noted how when he first got into the hemp business, he harvested acres by hand without using farm equipment, which he said was the most challenging work of his life.

Cohen said, “we’ve proved we could do it” on 50-acre plots, and they’re looking to move to 100-acre parcels.

Both companies agreed a challenge is the broken promises of the past when farmers were recruited to grow hemp and promised more significant amounts of profitability than other commodities per pound but ultimately were never paid.

Both companies agreed on the need to change the narrative and begin growing hemp the right way and the need to treat and talk about hemp as a traditional agriculture commodity.

Oregon State Global Hemp Innovation Center Director Retires and Announces He’s Leading the NIHC Foundation

Jay Noller, the Director of the Global Hemp Innovation Center (GHIC) at Oregon State University, announced at the end of NIHC’s 2022 Business, Research, and Farm Summit meeting that he will retire from the Global Hemp Innovation Center.

Noller will begin the new challenge of building and leading the NIHC Foundation.

Noller recounted his time as the head of the GHIC and the challenge of studying hemp varieties and the hemp industry in general before the passage of the Farm Bill by noting that he had to begin his research in Eastern Europe because hemp wasn’t yet legal.

“That’s why the Global Hemp Innovation Center says global,” Noller said in the name of Oregon State’s hemp research center before pointing out that he started his research overseas.

Noller says handwritten notes suggest the USDA had a research center originally in Corvallis to study hemp. But in 1970, the Nixon administration expunged all federal records of cannabis plants every existing.

“So, we have to reinvent a wheel,” he concluded but noted, “I think we’re well positioned to do it.”

Global Hemp Innovation Center Tour

NIHC’s 2022 Business, Farm, and Research Summit had a lot of fascinating discussions centered around the economics of hemp, the business of hemp, and the science of hemp.

As exciting as the two days’ worth of discussions were before we left Corvallis, we wanted to make sure to put the research into the Summit. As part of the registration, attendees were able to take a four-hour tour of Oregon State University’s Global Hemp Innovation Center (GHIC).

The GHIC is home to more than 60 experts focused on all aspects of hemp. GHIC is a comprehensive center that works to coordinate research, instruction, outreach, and engagement efforts to advance the establishment of this new-old crop into American agricultural landscapes. The Center seeks to create a holistic, results-driven, and scholarly ecosystem wherein faculty and students can effectively engage industry partners and work with other like-minded institutions to enable their activities in helping meet the growing world demand for food, health, fiber, and other consumer products made from hemp. The following were what attendees had an opportunity to visit and meet some of the researchers and learn about these exciting projects to advance our industry.

Building Materials. Construction materials testing and development, hempcrete, and building structure integrity testing. Department of Wood Science and Engineering, Richardson Hall, College of Forestry and Tallwood Design Institute.

Hosts: Dr. John Simonsen and Evan Schmidt.

Genetic Improvement. Hemp germplasm, breeding, and genomics. Greenhouses and Seed Certification/Testing Services. Departments of Crop and Soil Sciences and Horticulture, College of Agricultural Sciences. West Greenhouses.

Hosts: Drs. Stephen Baluch, Kelly Vining, and Bob Zemetra.

Cannabinoid Chemistry, Analyses, and Testing. Van Breemen Laboratory-Linus Pauling Institute. College of Pharmacy.

Hosts: Dr. Ruth Muchiri and Alan Wong.

Food and Beverage Development and Testing. Facilities for olfactory sensing, oil testing, and super-critical separations laboratory. Department of Food Science and Technology. Wiegand Hall. College of Agricultural Sciences.

Hosts: Drs. Paul Hughes and Michael Qian.

Business and Engineering Services and Support. College of Business: Center for Supply Chain Management, Center for Consumer Insights; and College of Engineering: Energy Efficiency Center / Industrial Assessment Center. Austin Hall.

Hosts: Drs. Johnny Chen, Zhaohui Wu, and Jonathan Leong (COB) and Dr. Karl Haapala, Maritza Perez, and Mario Israel Riofrio (COE).

Livestock Research Facilities. Utilization of hemp in diets of livestock that produce food products. Department of Animal and Rangeland Sciences, Hamb Building, West Campus. College of Agricultural Sciences.

Host: Dr. Serkan Ates.

We believe the entire team at Oregon State deserves our recognition and thanks for hosting us and helping us put together this amazing event. Special thank you to Dr. Staci Simonich, the Dean of Oregon State University’s College of Agriculture Sciences, and her entire faculty and staff. We also want to recognize Jay Noller, the Director of the Global Hemp Innovation Center; Associate Director Jeff Steiner; GHIC’s Center Administrator Kristin Rifai, and all of the researchers who helped us plan this event, took the time to visit with us and share with attendees the important work they’re doing to move our industry forward. We appreciate your hospitality, your partnership, and your commitment to pursuing the science of this wonderful plant that has the potential to meet a diverse set of needs and make the world a better place.