By Kevin Latner, NIHC Vice President for Trade and Marketing

The National Industrial Hemp Council (NIHC) is the only nationwide trade association dedicated to representing the U.S. industrial hemp industry supply chain, from farmers, to processors to brands and retailers, and end users and consumers. Since its inception in 2019, NIHC has supported industrial hemp and its products, improving the regulatory framework, and promoting the sustainable long-term growth and profitability of the industry through trade development and export promotion.

NIHC estimates that U.S. export of hemp and hemp-derivative products exceeded $1.8 billion in 2020, up from $310 million in 2019. Despite the challenges of the pandemic and regulatory uncertainty in both the U.S. and abroad, demand for hemp fibers, grain and oil continues its dramatic rise. Given the proper regulatory framework and market support, industrial hemp will provide U.S. farmers with another sustainable and profitable crop for the long-term.

NIHC has worked to build bridges within the hemp industry to work with registered member driven organizations to ensure that the entire hemp industry, and industry supply chain, is represented in international trade. A partial list of organizations NIHC has worked to build bridges with includes U.S. Hemp Growers Association, Hemp Industries Association, Hemp History Week, the Hemp Feed Coalition, the Midwest Hemp Council, the Texas Hemp Growers Association, the Southeast Hemp Association and Vote Hemp.

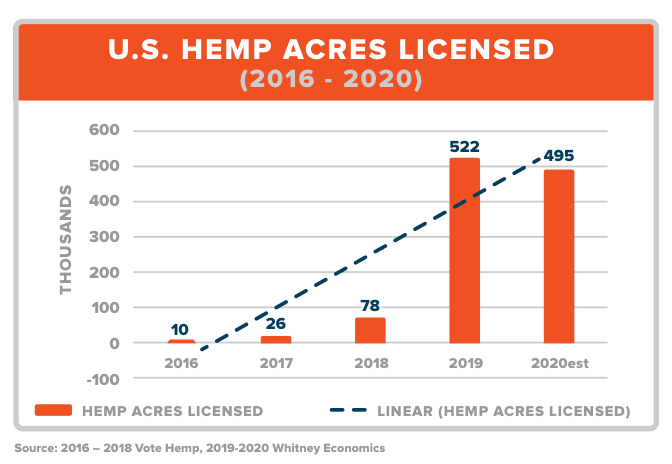

NIHC Chief Economist Beau Whitney reports that in 2020, licensed acreage totaled 495, down from 511,442 acres in 2019. This is nearly four times the acres licensed in 2018. Despite the decline in cultivated land in 2020, the number of growers increased significantly. In 2020, the number of licensed growers exceeded 21,000, increasing by more than 27% from 16,877 licensed growers in 2019. The increase in the number of licensed growers in 2020 is in addition to a 476% increase in licensed growers between 2018 and 2019, reflecting the accessibility of hemp to small and medium-sized farmers and business.

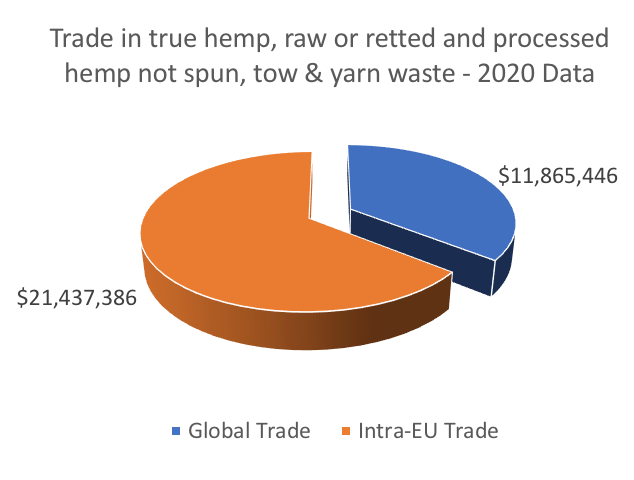

Trade numbers for exports of industrial hemp for fiber use (true hemp, raw or retted and processed hemp not spun, tow & yarn waste) were mixed. There were 306 metric tons of exports of industrial hemp for fiber (MT) in 2019. This was up from 255 MT in 2017. In 2020, that number declined to 148 MT.

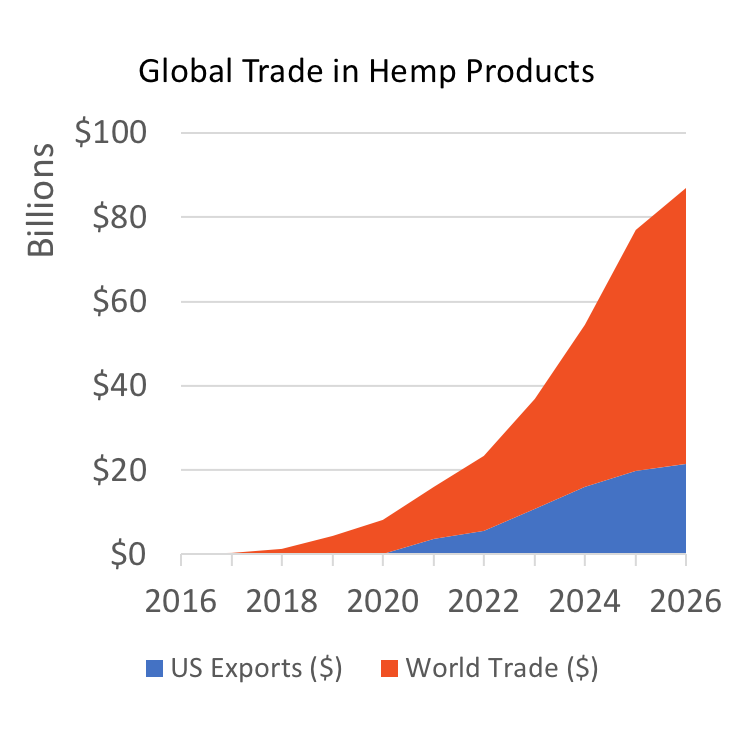

Export values were $0.79 million, down, however, from $8.9 million in 2017, to $2.8 million in 2018. Global trade of industrial hemp for fiber use has increased about 380% annually over the same time-period, but with significant volatility.(1) Global trade in industrial hemp and hemp-based products was over $8.1 billion in 2020 and is forecast to be more than $65 billion by 2026. NIHC estimated that U.S. exports of hemp seed, meal, oil and hemp-based processed products (including cannabidiol-based) exceeded $1.8 billion in 2020. U.S. exports of industrial hemp products are forecast over $21 billion by 2026.

Export values were $0.79 million, down, however, from $8.9 million in 2017, to $2.8 million in 2018. Global trade of industrial hemp for fiber use has increased about 380% annually over the same time-period, but with significant volatility.(1) Global trade in industrial hemp and hemp-based products was over $8.1 billion in 2020 and is forecast to be more than $65 billion by 2026. NIHC estimated that U.S. exports of hemp seed, meal, oil and hemp-based processed products (including cannabidiol-based) exceeded $1.8 billion in 2020. U.S. exports of industrial hemp products are forecast over $21 billion by 2026.

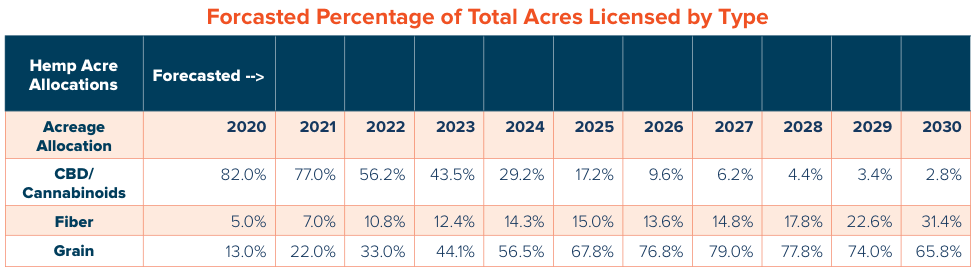

Industrial hemp for seed production accounts for approximately 15 percent of acreage. Reliable yield data for industrial hemp seeds production is not yet available. Additionally, trade number for hemp seeds are not separated out at the six-digit HTS Code level and while the U.S. tariff schedule includes a 10-digit HS code for hemp seed, historical trade numbers are not available in the CENSUS database. Industry forecasts are that seed demand will continue to grow and seed production will be 65 percent of production acreage by 2030. (2)

Production acres in the U.S. will expand to meet demand. Hemp will become a major commodity in the U.S. as measured by farm-gate sales, which will triple to top $10 billion a year by 2025. (3) Because of intermediate processing and downstream production, industrial hemp is forecast to improve farm profitability and improved rural livelihoods, providing market incentives for industrial hemp production. In 2019, hemp contributed 150,000 jobs and an estimated $4 billion in income to the farm community. (4) Export opportunities for U.S. industrial hemp will grow production faster than domestic use.

Export opportunities depend on regulatory certainty and the U.S. faces regulatory challenges in this area. One challenge is the delayed guidance from U.S. FDA on how CBD is treated in the food, supplement and nutraceutical markets; this despite NIHC’s ongoing discussions with FDA about the importance of regulatory certainty. The delay has resulted in ambiguity with respect to how these products are regulated and difficulty establishing international standards (see also Patrick Atagi’s “Developing Industry Standards and Best Practices”), even while the domestic market for these products have flourished.

Regulatory engagement and standards development has had significant impact in the international space where NIHC leads the industry in developing a coordinated response to evolving international standards. In June 2018, the WHO’s Expert Committee on Drug Dependence (ECDD) reviewed industrial hemp’s and CBD’s placement under international drug control treaties. NIHC worked with the U.S. government to develop positions consistent with deregulating hemp and minimizing treaty restrictions on cannabidiols. In June 2020, the WHO met to adopt standards consistent with NIHC and US government recommendations, providing an opening for increased harmonization and commercialization of industrial hemp.

Harmonization of international standards and certifications is a critical area for international engagement and central to NIHC’s role as the industries voice on international trade. NIHC has engaged experts to assess and monitor European and Asian markets. This has resulted in significant insights, including an assessment that there developing local trade centers that restrict international trade.

For example, in Europe trade in raw hemp and raw hemp fiber is two times the international trade. In other words, intra-European trade has exploded, while at the same time U.S. exporters find a challenging market because of ambiguous import requirements and inconsistent implementation by its member states. In China, recent regulatory changes increasingly limit U.S. export opportunities to hemp fiber.

Based on industry input, NIHC has developed both short-term and long-term responses in partnership with USDA’s Foreign Agricultural Service. In addition to engaging European and Asian trade experts, NIHC is building a communication strategy that will provide international visibility for the U.S. hemp industry. In the short-term this means ensuring that U.S. products, product availability and production standards are developed and shared.For the long-term, NIHC’s strategic vision includes expanding these efforts by partnering with USDA to understand the supply chain in target markets, identify market access constraints, develop technical solutions food, feed and supplement use along the value chain, and life cycle assessments to ensure that hemp generally, and US hemp in particular, is valued for its sustainability credentials.

Based on industry input, NIHC has developed both short-term and long-term responses in partnership with USDA’s Foreign Agricultural Service. In addition to engaging European and Asian trade experts, NIHC is building a communication strategy that will provide international visibility for the U.S. hemp industry. In the short-term this means ensuring that U.S. products, product availability and production standards are developed and shared.For the long-term, NIHC’s strategic vision includes expanding these efforts by partnering with USDA to understand the supply chain in target markets, identify market access constraints, develop technical solutions food, feed and supplement use along the value chain, and life cycle assessments to ensure that hemp generally, and US hemp in particular, is valued for its sustainability credentials.

1 Trade Data Monitor.

2 Whitney Economics Hemp Cultivation Report 2020 – Full Report.

3 WE_The-Field-of-Dreams_October_2019-1 (2019)

https://whitneyeconomics.com/2019/11/12/the-field-of-dreams-an-economic-survey-of-the-united-states-hemp-cultivation-industry/

4 Ibid.

Fazio (pictured) found his way into industrial hemp through a career in law enforcement. Like many others in the industry, he saw opportunity and had the ingenuity to pursue it.

Fazio (pictured) found his way into industrial hemp through a career in law enforcement. Like many others in the industry, he saw opportunity and had the ingenuity to pursue it.